LiquidationWatcher

New Opportunities in the Crypto Market Amid Changes in the Global Economic Landscape

Changes in the Global Economic Landscape and the Outlook for the Crypto Market

The current global situation is unpredictable. Although many people may have already realized this, it is still worth delving into the current economic landscape.

Although the crypto market has always been the focus of our attention, especially after confirming the bull market rebound following the Bitcoin halving, the market currently seems to have entered a relatively quiet phase. During this phase, most cryptocurrency holders have completed their investments, and choosing to wait and see may be a wise strategy.

For most investors, adopting a long-term investment perspective can simplify the decision-making process and reduce the need for frequent adjustments. Currently, the best options seem to be either holding long-term or betting on emerging popular tokens.

Regardless, this calm period in the crypto market provides us with an opportunity to examine the macroeconomy, which inevitably affects the trends of cryptocurrencies. After all, Bitcoin and other digital assets stem from the root

The current global situation is unpredictable. Although many people may have already realized this, it is still worth delving into the current economic landscape.

Although the crypto market has always been the focus of our attention, especially after confirming the bull market rebound following the Bitcoin halving, the market currently seems to have entered a relatively quiet phase. During this phase, most cryptocurrency holders have completed their investments, and choosing to wait and see may be a wise strategy.

For most investors, adopting a long-term investment perspective can simplify the decision-making process and reduce the need for frequent adjustments. Currently, the best options seem to be either holding long-term or betting on emerging popular tokens.

Regardless, this calm period in the crypto market provides us with an opportunity to examine the macroeconomy, which inevitably affects the trends of cryptocurrencies. After all, Bitcoin and other digital assets stem from the root

BTC2.55%

- Reward

- 10

- 7

- Repost

- Share

OnlyOnMainnet :

:

Waiting for memes to da moonView More

Hong Kong's new Web3 policy is on the verge of being implemented. How to balance regulation and innovation.

Hong Kong is actively promoting the development of Web3, attracting a large number of encryption companies and talents, and trying to become a global Web3 hub. Although the government provides strong support, the formulation of regulatory policies remains key. Finding a balance between ensuring innovation and effective regulation will determine the future direction of Hong Kong's development.

LUNA0.05%

- Reward

- 13

- 7

- Repost

- Share

LiquidityWizard :

:

Another regulation? So annoying.View More

Mega Matrix layout stablecoin track secures $16 million in financing targeting on-chain financial core

Mega Matrix Inc. Chief Strategy Officer Jia Songtao: Strategic Layout of the Stablecoin Track

Stablecoins, as an important component of the long-term order of future digital assets, are gradually becoming a bridge between the traditional financial system and the blockchain world. With the regulatory environment becoming increasingly clear, the stablecoin industry is ushering in unprecedented certainty and development opportunities. Against this backdrop, the US-listed company Mega Matrix Inc. has officially entered the core area of on-chain finance through a private financing round of 16 million dollars.

The company's Chief Strategy Officer, Jia Songtao, stated that this private financing is a key step in the company's strategic upgrade. Mega Matrix Inc. has transitioned from a holding company centered around a content platform to a systematic on-chain financial layout, particularly focusing on stablecoin treasury strategies.

Jia Songtao believes that the future world of digital assets will be built on public chains, stablecoins, and custody.

Stablecoins, as an important component of the long-term order of future digital assets, are gradually becoming a bridge between the traditional financial system and the blockchain world. With the regulatory environment becoming increasingly clear, the stablecoin industry is ushering in unprecedented certainty and development opportunities. Against this backdrop, the US-listed company Mega Matrix Inc. has officially entered the core area of on-chain finance through a private financing round of 16 million dollars.

The company's Chief Strategy Officer, Jia Songtao, stated that this private financing is a key step in the company's strategic upgrade. Mega Matrix Inc. has transitioned from a holding company centered around a content platform to a systematic on-chain financial layout, particularly focusing on stablecoin treasury strategies.

Jia Songtao believes that the future world of digital assets will be built on public chains, stablecoins, and custody.

View Original

- Reward

- 10

- 7

- Repost

- Share

WagmiWarrior :

:

So much money, I'm really envious.View More

- Reward

- 8

- 7

- Repost

- Share

GasFeeVictim :

:

Agreed, that's really great!View More

- Reward

- 9

- 7

- Repost

- Share

AirdropDreamBreaker :

:

Happy, send money, send moneyView More

While other chains optimize for TPS or liquidity, a certain network is building programmable IP for a creator-led, AI-native future.

This isn't a fork. It's a new category.

This isn't a fork. It's a new category.

IP4.09%

- Reward

- 11

- 7

- Repost

- Share

MevHunter :

:

Web3 Infrastructure NewsView More

NX Finance: A New Leader in Solana Decentralized Finance Ecosystem Returns

The yield layer of the Solana Decentralized Finance ecosystem: The innovation and development of NX Finance

Against the backdrop of the thriving Solana ecosystem, NX Finance stands out as an innovative yield aggregator. It aims to become the yield layer of the Solana Decentralized Finance ecosystem, offering users diversified yield strategies through yield leverage on earning assets and yield splitting of airdrop points.

The rise of the Solana Decentralized Finance ecosystem

Recently, the amount of funds on the Solana chain has significantly increased, with the total locked value ( TVL ) skyrocketing from 300 million USD to 4 billion USD from the third quarter of 2023 to July 2024. This growth is mainly attributed to the memecoin craze and the subsequent influx of substantial funds.

As funding increases, the demand for stable DeFi returns among users is also rising. Currently, on the Solana chain

Against the backdrop of the thriving Solana ecosystem, NX Finance stands out as an innovative yield aggregator. It aims to become the yield layer of the Solana Decentralized Finance ecosystem, offering users diversified yield strategies through yield leverage on earning assets and yield splitting of airdrop points.

The rise of the Solana Decentralized Finance ecosystem

Recently, the amount of funds on the Solana chain has significantly increased, with the total locked value ( TVL ) skyrocketing from 300 million USD to 4 billion USD from the third quarter of 2023 to July 2024. This growth is mainly attributed to the memecoin craze and the subsequent influx of substantial funds.

As funding increases, the demand for stable DeFi returns among users is also rising. Currently, on the Solana chain

- Reward

- 6

- 7

- Repost

- Share

degenwhisperer :

:

Crazy as it may be, stable returns must also be seized.View More

Steve Forbes calls for Stephen Miran, the nominee for Federal Reserve Governor, to be asked how important he thinks it is to have a dollar stable in value, and whether he believes that prosperity causes inflation.

IN-3.89%

- Reward

- 13

- 7

- Repost

- Share

ArbitrageBot :

:

The competition within the Fed is quite intense.View More

Federal Reserve Bank of Chicago President Austan Goolsbee said the central bank's meetings this fall will be "live" as he and his colleagues try to interpret mixed economic data and how best to adjust interest rates in response.

IN-3.89%

- Reward

- 9

- 7

- Repost

- Share

ChainSherlockGirl :

:

This data is messier than the chicken feathers in the hands of suckers.View More

Bitcoin pulled back after breaking through the 70,000 US dollars all-time high, with the net inflow of exchange ETFs continuing to rise.

Bitcoin has fallen back after hitting a new high, and market fluctuation has intensified.

On July 30, 2024, the Bitcoin price briefly broke through the $70,000 mark, reaching a new high of $70,050. This breakthrough sparked widespread attention and discussion in the market, but the peak did not last long, and the price quickly fell back. This price fluctuation once again highlights the high risks and uncertainties of the cryptocurrency market.

Nashville Bitcoin Conference Boosts Market Sentiment

The recent short-term surge in Bitcoin prices can be attributed in part to the Bitcoin conference held in Nashville, Tennessee, from July 25 to 27. The conference attracted global attention due to its scale and influence, as well as the attendance and speech of Trump.

Influential figures' statements affect the market

Trump proposed a series of suggestions regarding Bitcoin at the conference, including the establishment of a Bitcoin strategic reserve for the United States, and stated that he would fire the current chairman of the Securities and Exchange Commission. He claimed that the U.S.

On July 30, 2024, the Bitcoin price briefly broke through the $70,000 mark, reaching a new high of $70,050. This breakthrough sparked widespread attention and discussion in the market, but the peak did not last long, and the price quickly fell back. This price fluctuation once again highlights the high risks and uncertainties of the cryptocurrency market.

Nashville Bitcoin Conference Boosts Market Sentiment

The recent short-term surge in Bitcoin prices can be attributed in part to the Bitcoin conference held in Nashville, Tennessee, from July 25 to 27. The conference attracted global attention due to its scale and influence, as well as the attendance and speech of Trump.

Influential figures' statements affect the market

Trump proposed a series of suggestions regarding Bitcoin at the conference, including the establishment of a Bitcoin strategic reserve for the United States, and stated that he would fire the current chairman of the Securities and Exchange Commission. He claimed that the U.S.

BTC2.55%

- Reward

- 14

- 7

- Repost

- Share

MemecoinTrader :

:

just deployed the psyops playbook on nashville vibes... watching sentiment metrics go brrView More

Ethereum 2.0 staking standards met, Genesis Block launch imminent

According to the latest data from the Ethereum blockchain explorer, the staking contract for Ethereum 2.0 has reached the minimum requirements necessary to launch the Genesis Block. The amount of ETH deposited in the contract has exceeded 524,288 coins, and the achievement of this important milestone indicates that the Ethereum 2.0 network is expected to go live as scheduled on December 1.

This progress marks a key step towards a more efficient and scalable future for the Ethereum ecosystem. The successful filling of the stake contract not only demonstrates the community's confidence in Ethereum 2.0 but also lays a solid foundation for the upcoming network upgrade.

As the launch conditions are met, the Ethereum development team and community members are making final preparations for the upcoming major update. This upgrade will introduce a proof-of-stake consensus mechanism, which is expected to significantly enhance the network's performance and security.

Despite being a few days away from the official launch, the achievement of this milestone has already caused a wide stir in the cryptocurrency community.

This progress marks a key step towards a more efficient and scalable future for the Ethereum ecosystem. The successful filling of the stake contract not only demonstrates the community's confidence in Ethereum 2.0 but also lays a solid foundation for the upcoming network upgrade.

As the launch conditions are met, the Ethereum development team and community members are making final preparations for the upcoming major update. This upgrade will introduce a proof-of-stake consensus mechanism, which is expected to significantly enhance the network's performance and security.

Despite being a few days away from the official launch, the achievement of this milestone has already caused a wide stir in the cryptocurrency community.

ETH4.96%

- Reward

- 19

- 7

- Repost

- Share

WhaleWatcher :

:

It has risen again, guaranteed.View More

- Reward

- 11

- 6

- Repost

- Share

NotSatoshi :

:

Another airdrop eyewash, huh?View More

Solv founder Ryan: BTC staking and DeFi innovation will dominate the new cycle

Winners in the Crypto Assets Cycle: Insights from Ryan, Founder of Solv Protocol

In the turbulent cryptocurrency market, we had the privilege of interviewing Ryan, the founder of Solv Protocol, to discuss how to find a stable profit path in this high-risk, high-reward field.

Market Cycles and Investor Sentiment

The current "gold rush" in the crypto world is gradually cooling down. Market sentiment has shifted to panic, and investor confidence is gradually crumbling. The decline in Bitcoin prices has sparked widespread discussion about whether the bull market has already ended. However, the confidence of core investors has not wavered. Those who made significant gains in the last bull market still firmly believe in the long-term value of Crypto Assets and continue to increase their holdings.

Ryan believes that the cyclical dividends of the Crypto Assets industry have not completely disappeared. "It will probably last until around 2028, and opportunities still exist. However, this round of the cycle

In the turbulent cryptocurrency market, we had the privilege of interviewing Ryan, the founder of Solv Protocol, to discuss how to find a stable profit path in this high-risk, high-reward field.

Market Cycles and Investor Sentiment

The current "gold rush" in the crypto world is gradually cooling down. Market sentiment has shifted to panic, and investor confidence is gradually crumbling. The decline in Bitcoin prices has sparked widespread discussion about whether the bull market has already ended. However, the confidence of core investors has not wavered. Those who made significant gains in the last bull market still firmly believe in the long-term value of Crypto Assets and continue to increase their holdings.

Ryan believes that the cyclical dividends of the Crypto Assets industry have not completely disappeared. "It will probably last until around 2028, and opportunities still exist. However, this round of the cycle

- Reward

- 16

- 6

- Repost

- Share

CascadingDipBuyer :

:

Buy the dip again! My Wen Ge!View More

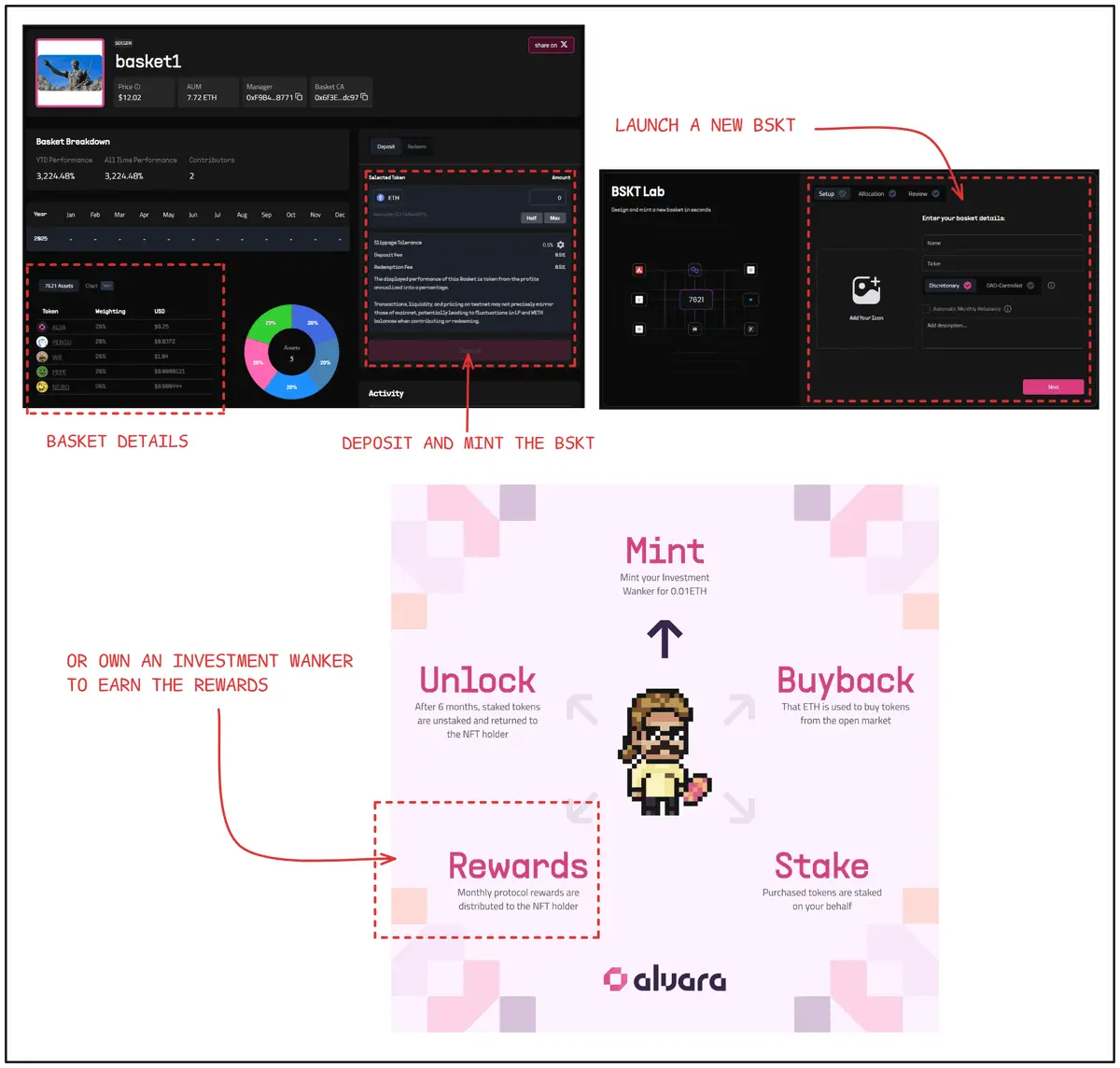

Does the term 'basket token' sound familiar to you?

If you've been following me closely, then you've seen mention of basket tokens before. They're pioneering the basket token, also known as the ERC-7621 standard.

They're launching the mainnet tomorrow, marking the start of the first

If you've been following me closely, then you've seen mention of basket tokens before. They're pioneering the basket token, also known as the ERC-7621 standard.

They're launching the mainnet tomorrow, marking the start of the first

- Reward

- 14

- 6

- Repost

- Share

YieldWhisperer :

:

ah yes... another "innovative" token standard. saw three similar ones fail spectacularly in 2021 tbhView More

The Central Bank released the financial Distributed Ledger specifications, Bitcoin whales suffered heavy losses from a hacker attack.

The Central Bank released security specifications for financial Distributed Ledger Technology, and Bitcoin whales lost a large amount of Tokens.

Recently, the People's Bank of China officially released the "Security Specifications for Financial Distributed Ledger Technology" industry standard. This standard stipulates the security system for financial distributed ledger technology, covering multiple aspects such as basic hardware, software, cryptographic algorithms, node communication, and ledger data. This standard was proposed and drafted by the Central Bank Digital Currency Research Institute, with participation from several large banks. Some analysts believe that with the introduction of this specification, the development of digital currency and blockchain supply chain finance is expected to accelerate.

In terms of regulation, the Central Bank stated that it aims to thoroughly resolve Internet financial risks and establish a sound long-term mechanism for Internet financial regulation. In Russia, the Central Bank and the Federal Security Service have reached an agreement to prohibit the use of cryptocurrencies as a means of payment. U.S. presidential candidate Michael Bloomberg proposed to formulate rules to clarify the status of crypto assets in the financial system.

line

Recently, the People's Bank of China officially released the "Security Specifications for Financial Distributed Ledger Technology" industry standard. This standard stipulates the security system for financial distributed ledger technology, covering multiple aspects such as basic hardware, software, cryptographic algorithms, node communication, and ledger data. This standard was proposed and drafted by the Central Bank Digital Currency Research Institute, with participation from several large banks. Some analysts believe that with the introduction of this specification, the development of digital currency and blockchain supply chain finance is expected to accelerate.

In terms of regulation, the Central Bank stated that it aims to thoroughly resolve Internet financial risks and establish a sound long-term mechanism for Internet financial regulation. In Russia, the Central Bank and the Federal Security Service have reached an agreement to prohibit the use of cryptocurrencies as a means of payment. U.S. presidential candidate Michael Bloomberg proposed to formulate rules to clarify the status of crypto assets in the financial system.

line

BTC2.55%

- Reward

- 13

- 8

- Repost

- Share

DeFi_Dad_Jokes :

:

Copying homework isn't fast enough, and now I have to manage virtual coins!View More

The price of Ethereum has recently shown a strong rise trend, reaching a value of 4600 USD as of August 13, 2025, which is only about 5% away from the ATH of 4871 USD set in November 2021. This rise has been corroborated by the performance of related ETFs.

In the Hong Kong market, four Ether ETFs recorded significant growth on August 13, with the China Asset Ether ETF achieving a daily rise of up to 8.32%. At the same time, the US market's spot Ethereum ETF also saw a large influx of funds, with a net inflow exceeding $1 billion for the first time on August 11.

Analysts point out that if the b

View OriginalIn the Hong Kong market, four Ether ETFs recorded significant growth on August 13, with the China Asset Ether ETF achieving a daily rise of up to 8.32%. At the same time, the US market's spot Ethereum ETF also saw a large influx of funds, with a net inflow exceeding $1 billion for the first time on August 11.

Analysts point out that if the b

- Reward

- 10

- 6

- Repost

- Share

BoredApeResistance :

:

enter a position enter a position bull run is coming!View More

Recently, the Ethereum (ETH) market has shown exceptionally active performance, attracting widespread attention in the crypto world. Since June of this year, institutional investors have accounted for 3.8% of ETH's circulating supply, a figure that is double that of Bitcoin, highlighting Ethereum's appeal among institutional investors.

At the same time, the introduction of the GENIUS Act in the United States provides new impetus for the adoption of stablecoins. It is worth noting that currently, over half of the stablecoins are issued on the Ethereum network, which further solidifies Ethereum'

View OriginalAt the same time, the introduction of the GENIUS Act in the United States provides new impetus for the adoption of stablecoins. It is worth noting that currently, over half of the stablecoins are issued on the Ethereum network, which further solidifies Ethereum'

- Reward

- 15

- 6

- Repost

- Share

BearEatsAll :

:

It's still the large institutions that understand it well.View More

Recently, Trump has once again called on the Fed to lower the interest rate to 1%, and his insistence is notable. This move echoes his earlier remarks about appointing a new chairman as soon as possible, with the remaining candidates reduced to three or four, highlighting the potential impact of political factors on economic policy.

At the same time, the cryptocurrency market is also witnessing new trends. Data shows that the top five entities holding Bitcoin currently hold a total of 772,000 Bitcoins, among which H100 Group recently increased its holdings by 45, bringing its total to 809 Bitc

View OriginalAt the same time, the cryptocurrency market is also witnessing new trends. Data shows that the top five entities holding Bitcoin currently hold a total of 772,000 Bitcoins, among which H100 Group recently increased its holdings by 45, bringing its total to 809 Bitc

- Reward

- 10

- 6

- Repost

- Share

SquidTeacher :

:

Hoarding and not selling is the way to goView More

In light of the current development trends in the Crypto Assets market, some analysts have put forward interesting viewpoints. Based on the possibility that the Fed may start cutting interest rates in September, an in-depth discussion on future market trends has been conducted.

The analyst believes that this bull market may peak in mid-2026, followed by a phase of high-level consolidation. Notably, he predicts that Bitcoin may peak ahead of the US stock market, which could be related to the introduction of Bitcoin ETFs providing more liquidity outflows.

Regarding the signals of the end of the

View OriginalThe analyst believes that this bull market may peak in mid-2026, followed by a phase of high-level consolidation. Notably, he predicts that Bitcoin may peak ahead of the US stock market, which could be related to the introduction of Bitcoin ETFs providing more liquidity outflows.

Regarding the signals of the end of the

- Reward

- 7

- 6

- Repost

- Share

WalletAnxietyPatient :

:

See you in 27 years, respect the first to run.View More

Load More

- Topic

21k Popularity

27k Popularity

112k Popularity

3k Popularity

19k Popularity

- Pin

- 🚀 ETH jumped to $4,600 this morning, up 8.69% in 24h!

Just shy of the $4,891 ATH—think it breaks through?

📍 Follow Gate_Square, vote and drop your reason.

🎁 4 winners split $100 Futures Voucher! - 📢 Exclusive on Gate Square — #PROVE Creative Contest# is Now Live!

CandyDrop × Succinct (PROVE) — Trade to share 200,000 PROVE 👉 https://www.gate.com/announcements/article/46469

Futures Lucky Draw Challenge: Guaranteed 1 PROVE Airdrop per User 👉 https://www.gate.com/announcements/article/46491

🎁 Endless creativity · Rewards keep coming — Post to share 300 PROVE!

📅 Event PeriodAugust 12, 2025, 04:00 – August 17, 2025, 16:00 UTC

📌 How to Participate

1.Publish original content on Gate Square related to PROVE or the above activities (minimum 100 words; any format: analysis, tutorial, creativ - 💙 Gate Square #Gate Blue Challenge# 💙

Show your limitless creativity with Gate Blue!

📅 Event Period

August 11 – 20, 2025

🎯 How to Participate

1. Post your original creation (image / video / hand-drawn art / digital work, etc.) on Gate Square, incorporating Gate’s brand blue or the Gate logo.

2. Include the hashtag #Gate Blue Challenge# in your post title or content.

3. Add a short blessing or message for Gate in your content (e.g., “Wishing Gate Exchange continued success — may the blue shine forever!”).

4. Submissions must be original and comply with community guidelines. Plagiarism or re - 🎉 The #CandyDrop Futures Challenge# is live — join now to share a 6 BTC prize pool!

📢 Post your futures trading experience on Gate Square with the event hashtag — $25 × 20 rewards are waiting!

🎁 $500 in futures trial vouchers up for grabs — 20 standout posts will win!

📅 Event Period: August 1, 2025, 15:00 – August 15, 2025, 19:00 (UTC+8)

👉 Event Link: https://www.gate.com/candy-drop/detail/BTC-98

Dare to trade. Dare to win.