Is the 8% rebound just an appetizer? Uniswap’s major upgrade could be UNI’s big comeback

Uniswap, the leading decentralized exchange on Ethereum, is preparing to strengthen its governance with legal protections. On August 11, the Uniswap Foundation (UF) submitted a proposal to the community, recommending that Uniswap DAO register as a Wyoming Decentralized Unincorporated Nonprofit Association (DUNA) and establish a new entity called DUNI.

If approved, Uniswap DAO would become the largest decentralized organization to adopt this legal framework so far. This move not only advances DAO regulatory compliance but also lays the legal groundwork for the long-debated fee switch.

DUNA: Legal Identity and Protection for DAOs

1. The Global Push for Legalization

DAOs are designed around on-chain autonomy and permissionless participation, but this vision often runs up against legal realities—DAOs without legal status can’t sign contracts, hire attorneys or accountants, open bank accounts, or defend themselves in legal disputes as independent entities.

Wyoming led the way in 2021 with its DAO LLC legislation, giving blockchain organizations a path to limited liability company status. In March 2024, the state advanced further with the DUNA Act, granting nonprofit DAOs lighter-weight legal recognition. Industry experts consider this legislative advance a cornerstone for global DAO compliance.

For investors, DUNA provides a legal identity and protection for DAOs:

- Legal identity: Once registered, the DAO can engage in contracts, work with law firms and auditors, and file with tax authorities just like traditional companies.

- Legal shield: Members are shielded from individual liability for the DAO’s legal or tax issues, providing protection against governance-related liabilities. If legal disputes or tax settlements arise, the entity, not individuals, bears the risk.

- Operational upgrade: Under DUNA, DAOs can hire service providers, retain professional advisors, and manage funds and compliance more efficiently.

Simply put, DUNA bridges the gap between DAOs operating in a legal “gray area” and those achieving full compliance, preserving decentralization while enabling real-world business functionality.

Proposal Details: Fund Allocation & Execution

The proposal outlines several major fund allocations and management structures for DUNI:

- $16.5 million in UNI tokens: allocated for historical tax liabilities (anticipated to be under $10 million) and the creation of a legal defense fund.

- $75,000 in UNI tokens: paid to Wyoming-based Cowrie, which will handle tax filings and financial reporting. Cowrie co-founder David Kerr helped draft the DUNA Act.

- Uniswap Foundation’s role: Acts as DUNI’s administrative agent, responsible for paperwork, contract execution, and hiring service providers.

- Cowrie’s role: Serves as DUNI administrator, providing ongoing tax and financial compliance.

The DUNA framework prohibits organizations from distributing dividends to members, except for reasonable service remuneration or expense reimbursement. This means that even if the fee switch is enabled, funds entering the DAO treasury cannot be paid directly to token holders—they must be allocated via governance for public expenditures, R&D, or incentives.

Fee Switch: A New Revenue Stream?

The fee switch is a reserved function in the Uniswap protocol designed to redirect a portion of liquidity providers’ (LPs) trading fees to the DAO treasury. For instance, under the current 0.3% trading fee, 0.05% could be redirected to a DAO-controlled pool.

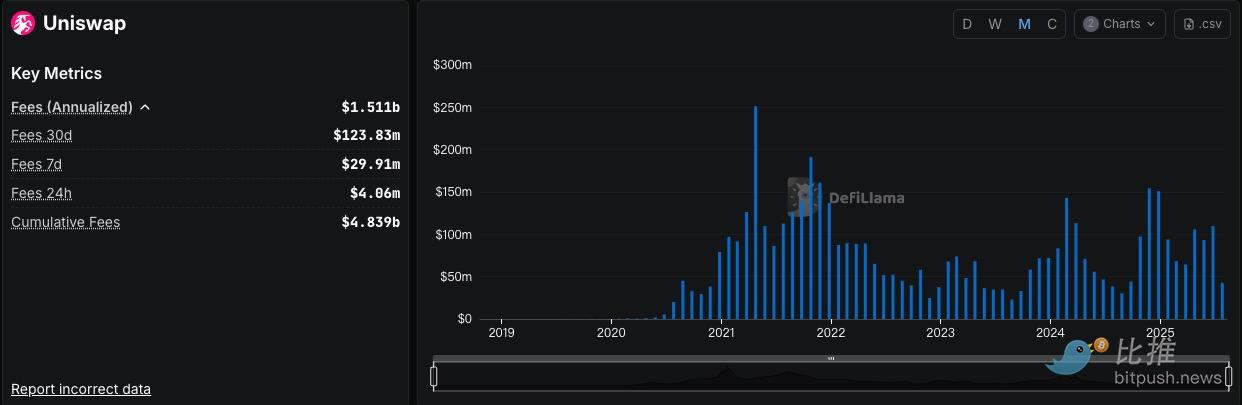

DefiLlama reports that Uniswap users paid over $123 million in swap fees last month. Even diverting just one-sixth of that amount to the DAO would generate approximately $20.5 million in monthly income, which annualizes to more than $240 million. This could significantly increase the scope of UNI’s governance and enhance its financial resources.

In previous years, proposals to activate the fee switch have repeatedly stalled over compliance risks. Ambiguous U.S. securities laws may make direct distribution of protocol revenue to token holders legally risky. DUNA is seen as a breakthrough in overcoming these regulatory hurdles.

Governance Power Dynamics: Ideals vs. Realities

Theoretically, DAOs are decentralized, but in practice, Uniswap’s governance is far more nuanced.

- Centralization of power

U.S. Representative Sean Casten pointed out in Congress that the Uniswap Foundation wields significant unilateral influence over governance, potentially undermining decentralization. Though UF denies holding outsized authority, major proposals are usually driven by the Foundation, and community-led initiatives rarely pass. - Venture capital influence

In 2023, UF withdrew a fee switch proposal after a major stakeholder raised concerns. Paradigm partner Dan Robinson accused the Foundation of caving to large venture capital interests, widely assumed to be a16z. Notably, a16z publicly praised DUNA as “an oasis for DAOs,” prompting some community members to fear that legal formalization could amplify capital control. - Balancing decentralization and efficiency

On-chain governance often struggles to balance broad participation with operational efficiency. Some projects (like LayerZero Foundation and Yuga Labs) have chosen to centralize certain functions to improve operational efficiency. Uniswap’s DUNA proposal also seeks this balance—between community ideals and practical performance.

The day the proposal was made public, UNI climbed almost 8% before pulling back, signaling market optimism for regulatory reform and new revenue. However, UNI remains historically depressed:

- All-time high (ATH): May 2, 2021, $44.97

- Current drawdown from ATH: approximately -75.76%

On-chain metrics show Uniswap maintains its market-leading position across Ethereum, Polygon, Arbitrum, Optimism, and other networks. Monthly transaction volume consistently ranges from $30 billion to $50 billion. Yet, the protocol’s low revenue capture continues to challenge UNI’s valuation.

Outlook: Compliance or Power Shift?

If the preliminary vote on August 18 passes, Uniswap DAO will become one of the first major decentralized organizations to adopt the DUNA model. This could establish a new industry standard for compliance and influence UNI’s value capture and sustainability.

Risks and opportunities are closely linked:

- Positives: Regulatory clarity reduces legal risks, and the fee switch could deliver stable cash flows and reinforce the UNI token’s value.

- Challenges: Centralized power and growing influence of outside capital may intensify internal governance tensions.

For investors, the DUNI proposal represents an industry-wide experiment in DAO maturity. The outcome will influence Uniswap’s trajectory and may serve as a model for DeFi projects seeking to balance compliance with decentralization.

Disclaimer:

- This article is reproduced from [BitpushNews], with copyright retained by the original author [BitpushNews]. For copyright concerns, please contact the Gate Learn team, who will address issues promptly according to internal protocols.

- Disclaimer: The views and opinions expressed herein belong solely to the author and do not constitute investment advice.

- Other language versions of this article are translated by the Gate Learn team and may not be copied, disseminated, or plagiarized unless referencing Gate.

Related Articles

In-depth Explanation of Yala: Building a Modular DeFi Yield Aggregator with $YU Stablecoin as a Medium

Sui: How are users leveraging its speed, security, & scalability?

What is Stablecoin?

Arweave: Capturing Market Opportunity with AO Computer

Exploration of the Layer2 Solution: zkLink