XRP Price Prediction: XRP Struggles Below $3 With Potential Drop to $2.83 as Cloud Mining Gains Attention

Foreword

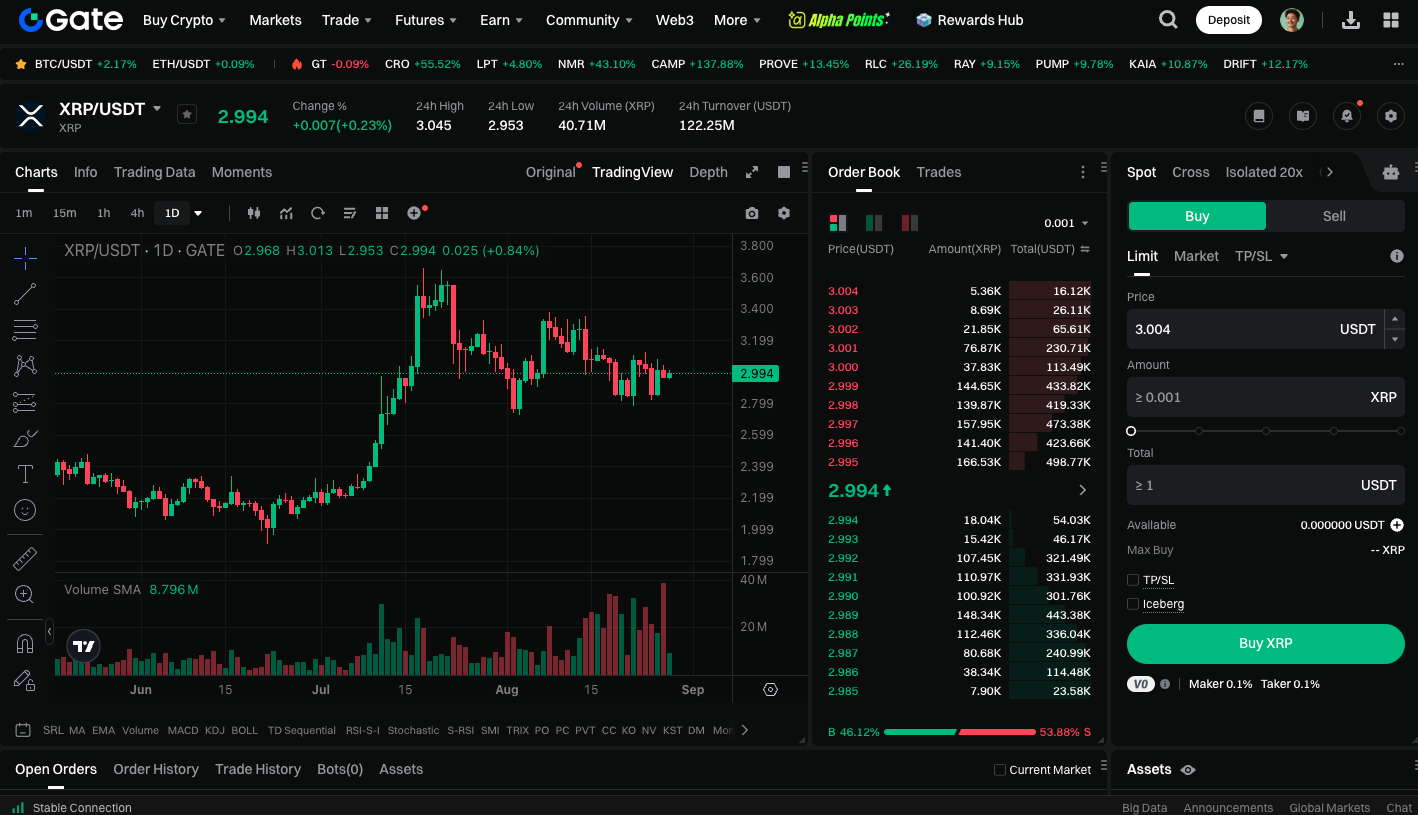

Recently, after reaching a record high of $3.65, XRP lost momentum and dipped below $3 within just a few weeks, shaking overall market sentiment. While the price made multiple attempts to break through resistance at $3.3 and $3.1, it ultimately failed to hold above either level. Should XRP remain unable to break out, it may see a short-term pullback to $2.83. Market analyst Ali Martinez has identified this level as a critical support target.

Investor Behavior and Market Contradictions

On-chain data reveals that major holders have continued offloading their positions, widely seen as a primary factor restraining any price rebound. Over the past year, XRP has posted remarkable gains, prompting some institutions and large investors to take profits at higher prices. This activity has intensified overall market uncertainty. In contrast, retail investors have shown a starkly different outlook, broadly confident in XRP’s significant potential for cross-border payments and financial use cases, and viewing it as a worthwhile asset for mid- to long-term holding. Meanwhile, professional traders and institutions remain much more cautious. Some commentators even suggest that XRP is the most disliked cryptocurrency among institutional investors.

Cloud Mining Applications Draw Attention

Despite ongoing price pressures, the market is seeing new developments. Siton Mining has introduced an XRP cloud mining application leveraging blockchain and green energy, enabling users to mine XRP from their mobile devices. This approach not only lowers hardware and maintenance costs but also achieves eco-friendly mining by utilizing distributed data centers and clean energy. Key features of the application include:

- Daily earnings: Mining rewards are settled automatically every day, allowing users to withdraw or reinvest at any time.

- Diverse contract selections: Options from short-term trials to long-term plans to meet varying investment needs.

- Fund security: Multi-layer encryption and ongoing risk monitoring ensure the safety of user assets.

- Global service: Coverage in over 180 countries with 24/7 multilingual customer support.

- Settlement in US dollars: All mining rewards are converted to US dollars, effectively reducing exposure to token price volatility.

This innovative service drives increased participation from retail and small-to-medium investors and expands real-world use cases for XRP.

Start trading XRP spot today: https://www.gate.com/trade/XRP_USDT

Conclusion

XRP continues to face resistance within the $3.1 - $3.3 range, and a failure to break through could see a short-term decline to $2.83. However, with the rollout of cloud mining and similar applications, XRP’s ecosystem is steadily expanding, potentially laying the groundwork for stronger long-term value.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

How to Sell Pi Coin: A Beginner's Guide

Grok AI, GrokCoin & Grok: the Hype and Reality

Flare Crypto Explained: What Is Flare Network and Why It Matters in 2025