Search result of PBTC35A

Courses (0)

Articles (16)

Glossary (0)

Pi Network rebounds 35% before Pi2Day: Can the price rebound continue?

$5 billion spent in 35 days—can ETH truly reach $15,000?

Gate Research: Ethereum ETF Inflows Hit $1.66B in December, NFT Market Trading Volume Up 35% WoW

The Modular Watchlist for 2024 - 35 Modular Protocols You Should Know

The Modular Watchlist for 2024 - 35 Modular Protocols You Should Know

What Is dYdX? All You Need to Know About DYDX

Understanding AVA AI: As the Flagship Agent IP of Holoworld AI, What is its Value?

Gate Research : The Fed Holds Rates Steady Again|ETH Staking Hits All-Time High

The Next NOTCOIN? Exploring the Addictive, Top-Ranked Game Catizen on TON

A Detailed Guide on Monad and Potential Airdrop Opportunities

A Comprehensive Overview of Molecule

What is a SharkFin Structured Product in 2025?

Gate Research: May Crypto Market Review

![<p>More than a decade after crypto’s meteoric rise, Bitcoin’s quadrennial halving-driven gold rush has faded. Now, intermittent liquidity injections from U.S. equities, the dollar, and Treasuries drive the market. Each cycle links together distinct hotspots, much like Pendle’s evolution from fixed income and LST, through BTCFi, to Ethena and Boros.</p>

<p>Creating new wealth is harder than managing old money.</p>

<p>As custodians put it: money flows to those who already have it.</p>

<p>In crypto, true whales come in three types: individual giants (early BTC miners, early ETH investors, DeFi Summer OGs); on-chain institutions (crypto-native VCs, centralized exchanges and public blockchains, and a handful of project teams); and long-standing or new titans backed by Wall Street.</p>

<p><img src="https://s3.ap-northeast-1.amazonaws.com/gimg.gateimg.com/learn/9ed6c1c583d01f3ccbdb76a46511deac93a9d4fc.png" alt=""><br>Image Description: Custodian Funding Boom<br>Image Source: <a href="https://github.com/zuoyeweb3" title="@zuoyeweb3" class="at-link">@zuoyeweb3</a></p>

<p>Custody providers have since specialized further. After $3 billion in funding in 2021 and the FTX–Celsius and 3AC–Luna–UST collapses in 2022, the crypto custody space crystallized into the following segments:</p>

<ul>

<li>• Copper/Ceffu/Cobo: On-chain project support</li><li>• Coinbase: ETF custody</li><li>• BNY Mellon: Banking-grade custody</li><li>• Fireblock: Exchange custody solutions</li></ul>

<p>Coinbase, in particular, has captured nearly the entire ETF custody market: over 80% of BTC and ETH ETF issuers now partner with Coinbase. In corporate treasury management, MSTR also prefers Coinbase as its BTC custodian.</p>

<h2 id="h2-5Li65pWj5oi35Lqk5piT5pe25Luj57uT5p2f77yM5Li65py65p6E55CG6LSi5pe25Luj5Yiw5p2l">The Era of Retail Trading Is Over: Institutions Take the Lead in Crypto Wealth Management</h2><p>The ways to profit in crypto evolve with the times. With capital scale effects at play, whoever controls the most assets secures the greatest profits. Miners, exchanges, and market makers have each had their day; next up are custodians. As traditional finance capital moves on-chain, these funds will rarely go straight to public chains or exchanges—instead, they’ll flow through custodians.</p>

<p>Ethereum’s daily transactions have surged past the DeFi Summer peak, hitting 1.74 million. Yet, this growth isn’t driven by memes or trading, but by stablecoin looping and borrowing, prompted by Aave and Ethena.</p>

<p>Similarly, Aave and Plasma are partnering to bring a TradFi-focused stablecoin on-chain. The Genius Act prohibits payment stablecoins from paying user interest, turning deposited funds into liabilities with nowhere to go—dead weight for issuers.</p>

<p>At the same time, as CEX trading volume shrinks, custodial, staking, and yield products are becoming new business targets for traditional banks, especially as rate cuts loom. The challenge now is how to attract liquidity from 401(k)s and corporate treasury strategies to on-chain products—a new business frontier.</p>

<p>The centralized exchange cycle is at its end, squeezed by both on-chain models and IPO ambitions. Hyperliquid is threatening Binance’s dominance, while Kraken, Bullish, and others are taking aim at Coinbase’s status as the only U.S.-listed exchange.</p>

<p>Strategically, everyone is chasing post-CEX yield opportunities. For institutional capital, safety takes priority over high APRs. Tether’s physical gold vault is one approach; on-chain vaults could be equally lucrative.</p>

<p>With ETFs taking the lead, Coinbase’s dominance is hard to shake—yet the evolving market landscape still offers openings for second- and third-tier players.</p>

<p><img src="https://s3.ap-northeast-1.amazonaws.com/gimg.gateimg.com/learn/49c0f9bfe131845f1d8c6209cce74da4678a5f2a.png" alt=""><br>Image Description: TradFi & DeFi Merge<br>Image Source: <a href="https://github.com/zuoyeeb3" title="@zuoyeeb3" class="at-link">@zuoyeeb3</a></p>

<p>Compared to the sheer scale of capital pouring into the dollar, Treasuries, and U.S. equities, crypto is still just catching what it can in a small bucket. Only a big, secure “bathtub” will allow true, seamless liquidity flows.</p>

<p>Veteran players are diverging, and Anchorage Digital and Galaxy Digital now stand out as the industry’s two flagship examples.</p>

<ul>

<li>• Treasury management (DATCO): Galaxy</li><li>• Stablecoins: Anchorage</li><li>• Emerging ETF staking: Anchorage Digital & Galaxy Digital</li></ul>

<p>Apart from BTC and spot ETF businesses, both companies target the same thing—taking more market share from Coinbase. This is a logical starting point.</p>

<p>The spot ETF market now features two main trends: generalization (altcoins and meme coins, after six months of Coinbase derivatives trading, may become eligible for conversion into ETFs); and the rise of staking ETFs, which allow issuers to offer physical redemptions and tap into on-chain staking revenue.</p>

<p>Anchorage Digital, for example, is the exclusive custodian and staking partner for the REX-Osprey Solana Staking ETF—fitting both these trends. If the bull market continues, ETF custody will be a key growth engine for these firms.</p>

<p>On the traditional ETF front, Anchorage has won mandates from 21Shares and BlackRock—and is even custodian for Trump Media’s Bitcoin treasury. Anchorage’s reach now extends all the way to Mar-a-Lago.</p>

<h2 id="h2-QW5jaG9yYWdlIOaMgeeJjOmTtuihjOeahOeos+WumuW4geW4g+WxgOS4juWKoOWvhumTgemHkeW6k+S5i+aipg==">Anchorage: Licensed Banking for Stablecoins and the Pursuit of the Crypto Fort Knox</h2><p>In 2019, Anchorage began exploring partnerships with Visa, becoming Visa’s USDC settlement bank in 2021.</p>

<p>In 2021, Anchorage launched its crypto custody business at a $3 billion valuation, received a crypto bank charter from the OCC, and began providing digital asset custody for the U.S. Marshals Service (USMS).</p>

<p>In 2022, following the crypto crash, Anchorage was first choice for Aptos custody, with co-founder Diogo Mónica also an Aptos investor.</p>

<p>In Q1 2023, platform assets grew 80%, though 75 employees (20%) were laid off and the company called for stablecoin regulation.</p>

<p>In 2024, co-founder Diogo Mónica stepped away from daily operations, with Nathan McCauley assuming full responsibility.</p>

<p>By 2025, Anchorage Digital will manage Trump Media’s Bitcoin treasury and has acquired USDM issuer Mountain Protocol.</p>

<p>Here’s a formal introduction: Anchorage Digital was founded in 2017 by Nathan McCauley and Diogo Mónica, initially as a small trust in South Dakota. But in 2021, a twist of fate made Anchorage Digital the only recipient, so far, of an OCC-issued crypto bank charter in the U.S.</p>

<p>In Silicon Valley, Wall Street, or D.C., exclusive financial services are, at their core, all about relationships.</p>

<p><img src="https://s3.ap-northeast-1.amazonaws.com/gimg.gateimg.com/learn/0edcae8d144bdddd0f94aa619c23aa98be29267b.png" alt=""><br>Image Description: Anchorage Digital’s Relationship Map<br>Image Source: <a href="https://github.com/zuoyeweb3" title="@zuoyeweb3" class="at-link">@zuoyeweb3</a></p>

<p>Anchorage Digital built a full-service institutional platform—trading, derivatives, clearing, staking, custody—making it a one-stop crypto solution for institutions. Beyond traditional custody, Anchorage is betting the company’s future on stablecoins, its key difference from Galaxy.</p>

<p>This marks the beginning of their first-mover advantage, where timing proved critical.</p>

<p>In 2021, Democrat Joe Biden, a noted crypto skeptic, became president. SBF donated millions to support Biden in hopes of a “crypto spring.” Meanwhile, former Coinbase CLO Brian Brooks became Acting Comptroller of the OCC.</p>

<p>Brooks promoted a crypto-friendly stance, opened banking services to the sector, launched the “REACh” roundtable, and encouraged banks to treat crypto firms fairly.</p>

<p>Anchorage seized the opportunity, transforming from a local trust to Anchorage Digital Bank—a true national bank.</p>

<p>On January 13, 2021, Anchorage Digital Bank was qualified to accept USD deposits and custody crypto assets.</p>

<p>The next day, January 14, Brooks resigned. By a fluke of timing, Anchorage Digital became the sole licensed crypto bank in the United States.</p>

<p>Today, virtually every page of Anchorage Digital’s site touts the value of its charter—it enabled $430 million in Series C and D funding, keeping the company afloat for the 2025 stablecoin surge.</p>

<p>Anchorage boasts an impressive cap table: both crypto VCs like a16z and Wall Street giants like KKR and BlackRock have invested.</p>

<p>For context, Bitpay and Paxos also applied for a charter, but weren’t so lucky. Recently, Paxos was hit by a $26.5 million New York DFS fine for BUSD non-compliance.</p>

<p>In addition to its federal OCC crypto bank charter, Anchorage also holds a New York State BitLicense—second only to BNY in regulatory status.</p>

<p>After Brooks’s departure, Anchorage and the OCC had their disagreements, but Anchorage kept its charter—holding a unique license provides a lasting advantage.</p>

<p>Thanks to this regulatory status, Anchorage can custody everything from stablecoin reserves and crypto to NFTs. But the 2022 crypto crash disrupted the firm, with leadership clashes following soon after.</p>

<p>Ultimately, Diogo Mónica joined Hanu Ventures as a partner, remains Anchorage Digital’s executive chairman, leads hiring and strategy, and Nathan McCauley handles core operations—focusing on capturing BlackRock’s stablecoin business.</p>

<p>Anchorage is now custodian for 21Shares’ BTC and ETH spot ETFs and exclusive custodian and staking partner for the REX-Osprey Solana Staking ETF.</p>

<p>But beyond ETFs, Anchorage Digital has made major headway—especially in stablecoins: collaborating with Visa on stablecoin payments and onboarding “compliant” stablecoins like PayPal’s PYUSD for institutional investors.</p>

<p>Remarkably, Tether’s custodian and investor Cantor Fitzgerald has also teamed up with Anchorage to handle Bitcoin custody for Cantor Fitzgerald’s business.</p>

<p>That makes Anchorage the custodian to Tether’s custodian.</p>

<p>Despite its regulatory edge, Anchorage’s business was relatively quiet before 2025. Even with a $3 billion valuation and $50 billion in assets under management (AUM), it struggled to challenge Coinbase in the ETF space. Stablecoins are Anchorage Digital’s real battleground.</p>

<p>With its federal “crypto bank” charter, Anchorage Digital (through Anchorage Digital Bank NA) can accept both USD and stablecoin deposits, and provide custody services.</p>

<ul>

<li>• Off-chain: Anchorage is partnering with Ethena to scale up USDtb issuance and comply with Genius Act stablecoin requirements.</li><li>• On-chain: Anchorage is part of the USDG stablecoin alliance with Paxos and Kraken, operating the Global Dollar Network on-chain.</li></ul>

<p>In treasury strategy, Anchorage is not idle: former BlackRock exec Joseph Chalom joined ETH treasury firm Sharplink Gaming as co-CEO and drove the BlackRock–Anchorage ETF custody partnership.</p>

<p>BlackRock’s BUIDL fund is closely linked to Chalom, and Anchorage serves as custodian. The structure:</p>

<p>$BUIDL = BlackRock issuance = Securitize (tokenization tech) + Anchorage Digital (custody) + BNY (cash management)</p>

<p>There’s more: SEC Chair Paul Atkins owns at least $250,000 of Anchorage Digital shares and is also a Securitize stakeholder; Securitize is Ethena’s joint partner for Converage.</p>

<p>With Galaxy listed publicly, speculation about an Anchorage Digital IPO is growing as the stablecoin business expands—perhaps this will be the year of the first crypto bank IPO.</p>

<h2 id="h2-R2FsYXh5IERpZ2l0YWwg5Z2Q5LiK6LSi5bqT5pe25Luj55qE6ZOB546L5bqn">Galaxy Digital: Sitting Atop the Crypto Treasury Throne</h2><p>Galaxy Digital stands out even more than Anchorage. It was Goldman Sachs’s OTC crypto trading partner in 2022, a major Bitcoin whale exit hub, and is involved in BTC mining, VC investment, and AI compute. Founder Mike Novogratz’s connections are unmatched in the industry.</p>

<p>On July 25, Galaxy helped an early miner sell about 80,000 BTC ($9 billion). Although the sales were staggered, the news pushed Bitcoin down nearly 4% to below $115,000.</p>

<p>Given the sums involved, Galaxy has faced accusations of market manipulation, but as an institution, Galaxy’s incentives are for low volatility and scale—institutions want stability, not chaos.</p>

<p>However, Galaxy’s real advantage is its timing: founder Mike Novogratz—trained in traditional finance, not tech—has always approached crypto pragmatically, focusing on profitability.</p>

<p>Now, as retail exits and institutions enter, Galaxy’s next steps—especially the broadening of crypto treasury strategies—demand attention.</p>

<p>Recall that ETH treasury company Sharplink, recently led by a BlackRock executive?</p>

<p>In June 2025, Sharplink made multiple large ETH buys via Galaxy OTC, totaling at least $800 million. Galaxy is also a Sharplink investor—internal capital cycling within related entities.</p>

<p>Beyond BTC and ETFs, Galaxy has contributed to Ethena’s Stablecoinx treasury effort and built the $450 million Mill City Ventures III, Ltd. $SUI treasury.</p>

<p>Galaxy is also expanding into new OTC products, such as OTC support for LST LsETH (Liquid Collective issuance). For the SOL version (lsSOL), institutional investors are supported by Anchorage Digital.</p>

<p>It’s a tight circle at the top of crypto finance.</p>

<p>Notably, both Anchorage Digital and Galaxy Digital are now involved in GDN, proving that collaboration, not cutthroat competition, is the new norm among major custodians.</p>

<p>While Anchorage is betting its future on stablecoins (thanks to its banking charter), Galaxy focuses on treasury management, with additional non-BTC and non-ETH treasury products forthcoming.</p>

<p>With substantial capital depth, Galaxy holds $1.8 billion in BTC, recently increased its XRP holdings by $34.4 million, and in a twist, Ripple just announced a $200 million acquisition of stablecoin firm Rail (backed by Galaxy).</p>

<p>Internal capital cycling within related entities.</p>

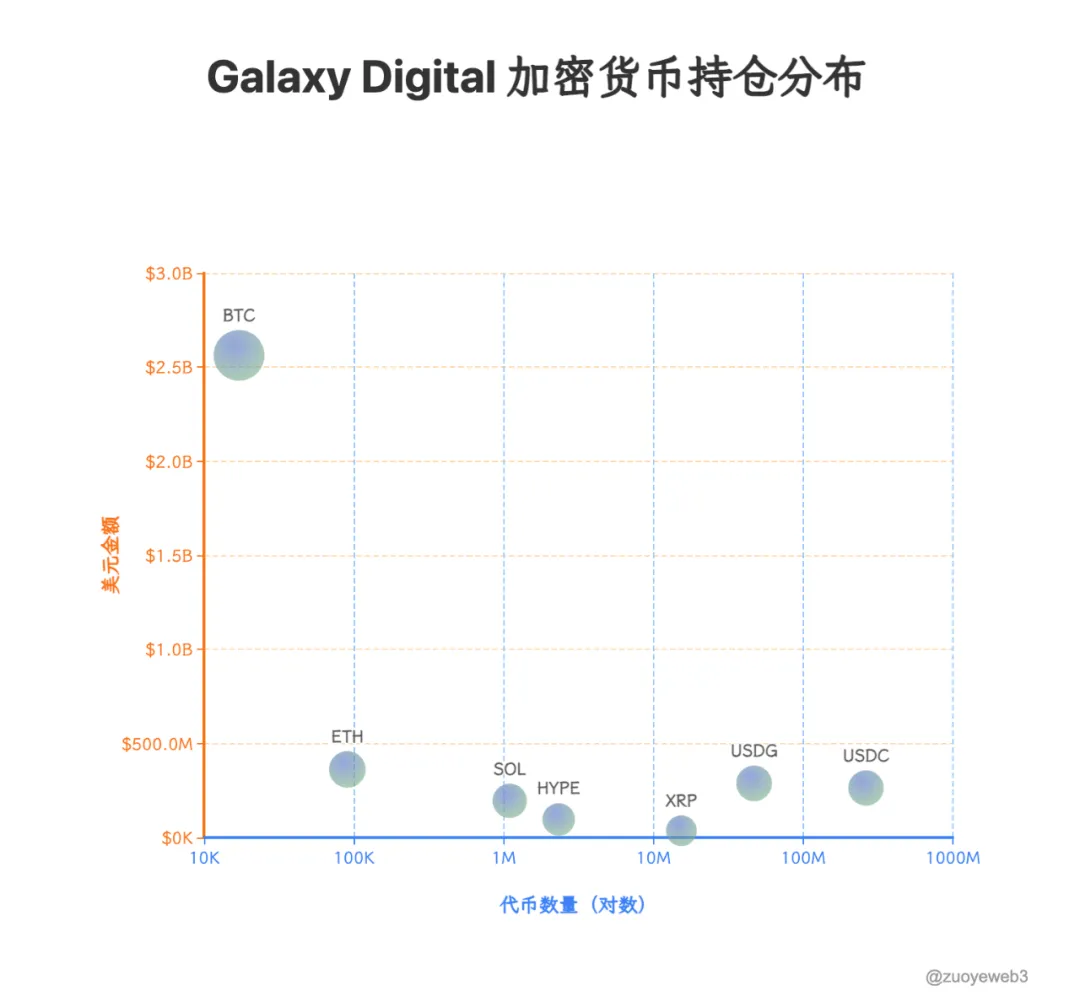

<p>Galaxy’s filings hint at new treasury and market-making targets: $HYPE, $SOL, and $XRP. After Ripple ended its SEC litigation and soared 10% the same day, Galaxy pulled ahead of retail once more.</p>

<p><img src="https://s3.ap-northeast-1.amazonaws.com/gimg.gateimg.com/learn/537e2129a57a2a54d0b97276c3a7a0bd7e8d038c.png" alt=""><br>Image Description: Galaxy Digital Portfolio<br>Image Source: <a href="https://github.com/zuoyeweb3" title="@zuoyeweb3" class="at-link">@zuoyeweb3</a><br>Data Source: <a href="https://github.com/SECGov" title="@SECGov" class="at-link">@SECGov</a></p>

<p>Galaxy has completely exited its UNI and TIA positions. The previous leading assets have been replaced: USDG, HYPE, and XRP are the new stars—OTC desks always spot the trends first.</p>

<p>Historically, OTC desks could only passively fill whale orders, with little sway over secondary markets—unlike exchange-based market makers. However, with on-chain treasury strategies, crypto, equities, and bonds will become interconnected; who will control token pricing remains uncertain.</p>

<h2 id="h2-57uT6K+t">Conclusion</h2><p>Custodians are the new crossroads of capital in crypto. Off-chain assets demand secure on-chain entry; on-chain assets require compliant off-ramps. Treasury strategies will let custodians actively shape token prices. Crypto liquidity now defines the power structure, while the era of centralized exchanges and market makers is coming to an end.</p>

<p>BNY Mellon holds over $52 trillion in assets under custody. The entire crypto market cap is less than $4 trillion, and stablecoins + crypto ETFs + treasury firms total just $520 billion—crypto custodians’ influence will take time to mature.</p>

<p>Ultimately, capital will follow profit opportunities.</p>

<h3 id="h3-5aOw5piO77ya">Disclaimer:</h3><ol>

<li>This article is reprinted from [<a href="https://mp.weixin.qq.com/s/235iFbT1Qv0DWFjL__cS_w">Zuoye WaiBoShu</a>]. Copyright remains with the original author [<em>Zuoye WaiBoShu</em>]. If there are any objections to this reprint, please contact the <a href="https://www.gate.com/questionnaire/3967">Gate Learn</a> team, and we will address it according to our procedures.</li><li>Disclaimer: The views and opinions expressed in this article belong solely to the author and do not constitute investment advice.</li><li>Other language versions of this article were translated by Gate Learn. Unless <a href="http://gate.com/">Gate</a> is specifically referenced, translated content may not be copied, distributed, or plagiarized.</li></ol>](https://gimg.gateimg.com/learn/f74d4750d5851bfce39d336acd6fc974d4f3090e.webp)

More than a decade after crypto’s meteoric rise, Bitcoin’s quadrennial halving-driven gold rush has faded. Now, intermittent liquidity injections from U.S. equities, the dollar, and Treasuries drive the market. Each cycle links together distinct hotspots, much like Pendle’s evolution from fixed income and LST, through BTCFi, to Ethena and Boros.

Creating new wealth is harder than managing old money.

As custodians put it: money flows to those who already have it.

In crypto, true whales come in three types: individual giants (early BTC miners, early ETH investors, DeFi Summer OGs); on-chain institutions (crypto-native VCs, centralized exchanges and public blockchains, and a handful of project teams); and long-standing or new titans backed by Wall Street.

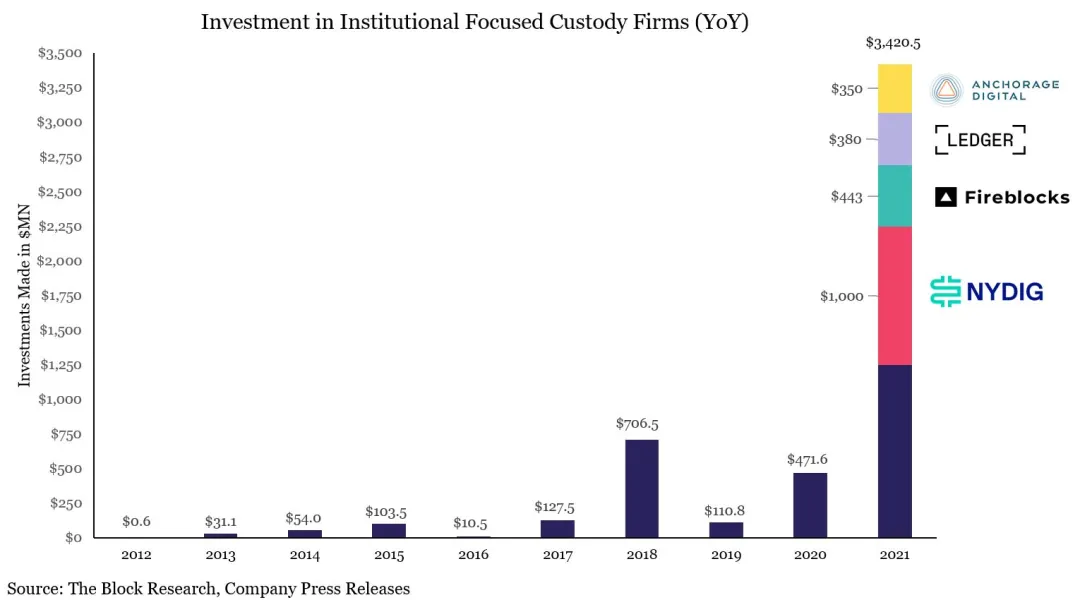

Image Description: Custodian Funding Boom

Image Source: @zuoyeweb3

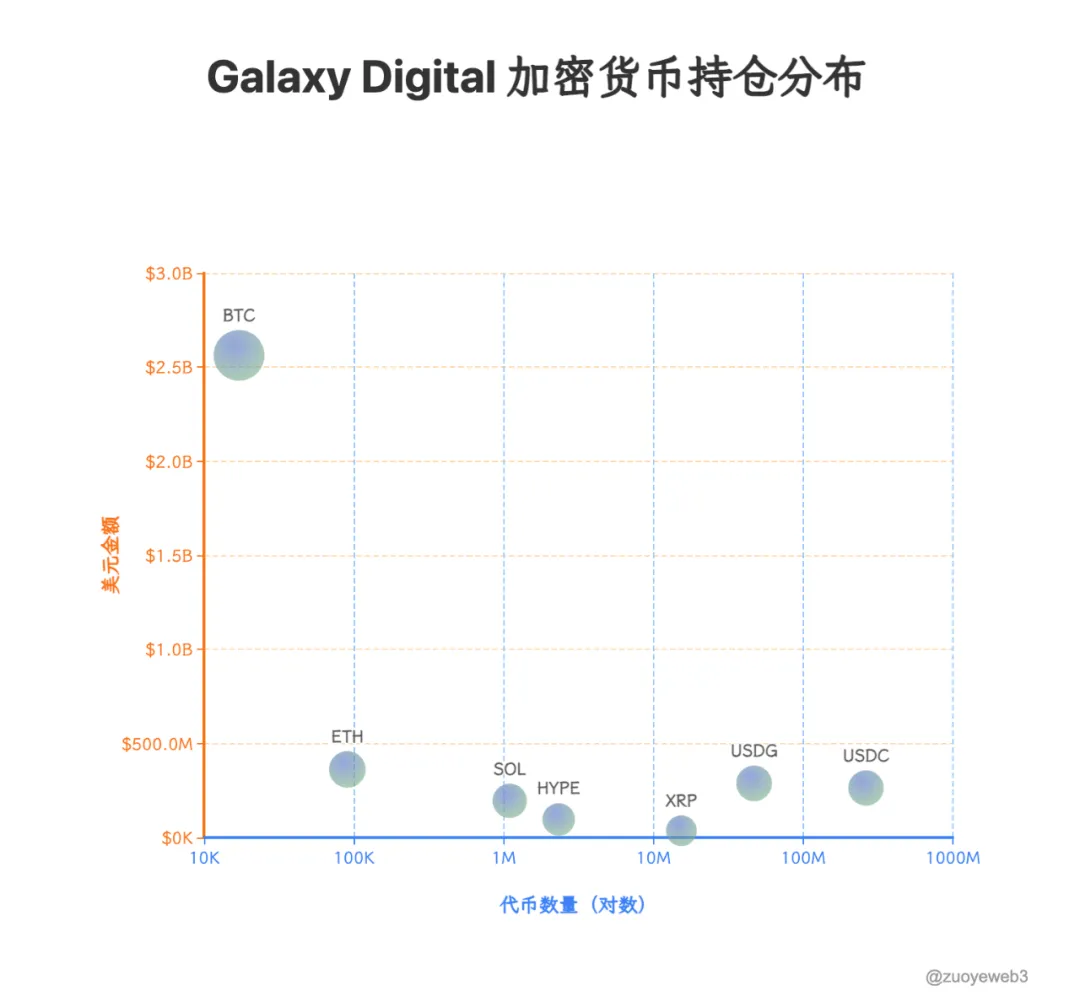

Custody providers have since specialized further. After $3 billion in funding in 2021 and the FTX–Celsius and 3AC–Luna–UST collapses in 2022, the crypto custody space crystallized into the following segments:

- • Copper/Ceffu/Cobo: On-chain project support

- • Coinbase: ETF custody

- • BNY Mellon: Banking-grade custody

- • Fireblock: Exchange custody solutions

Coinbase, in particular, has captured nearly the entire ETF custody market: over 80% of BTC and ETH ETF issuers now partner with Coinbase. In corporate treasury management, MSTR also prefers Coinbase as its BTC custodian.

The Era of Retail Trading Is Over: Institutions Take the Lead in Crypto Wealth Management

The ways to profit in crypto evolve with the times. With capital scale effects at play, whoever controls the most assets secures the greatest profits. Miners, exchanges, and market makers have each had their day; next up are custodians. As traditional finance capital moves on-chain, these funds will rarely go straight to public chains or exchanges—instead, they’ll flow through custodians.

Ethereum’s daily transactions have surged past the DeFi Summer peak, hitting 1.74 million. Yet, this growth isn’t driven by memes or trading, but by stablecoin looping and borrowing, prompted by Aave and Ethena.

Similarly, Aave and Plasma are partnering to bring a TradFi-focused stablecoin on-chain. The Genius Act prohibits payment stablecoins from paying user interest, turning deposited funds into liabilities with nowhere to go—dead weight for issuers.

At the same time, as CEX trading volume shrinks, custodial, staking, and yield products are becoming new business targets for traditional banks, especially as rate cuts loom. The challenge now is how to attract liquidity from 401(k)s and corporate treasury strategies to on-chain products—a new business frontier.

The centralized exchange cycle is at its end, squeezed by both on-chain models and IPO ambitions. Hyperliquid is threatening Binance’s dominance, while Kraken, Bullish, and others are taking aim at Coinbase’s status as the only U.S.-listed exchange.

Strategically, everyone is chasing post-CEX yield opportunities. For institutional capital, safety takes priority over high APRs. Tether’s physical gold vault is one approach; on-chain vaults could be equally lucrative.

With ETFs taking the lead, Coinbase’s dominance is hard to shake—yet the evolving market landscape still offers openings for second- and third-tier players.

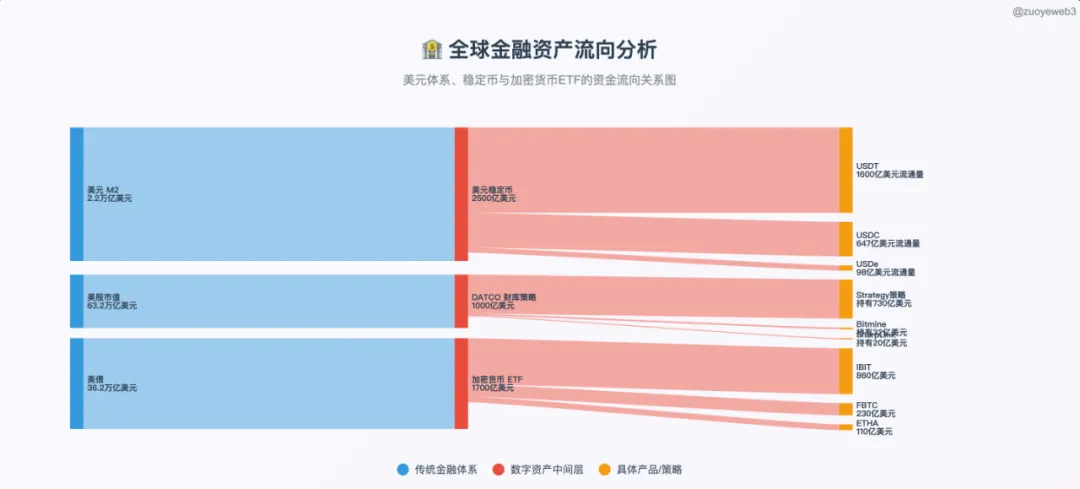

Image Description: TradFi & DeFi Merge

Image Source: @zuoyeeb3

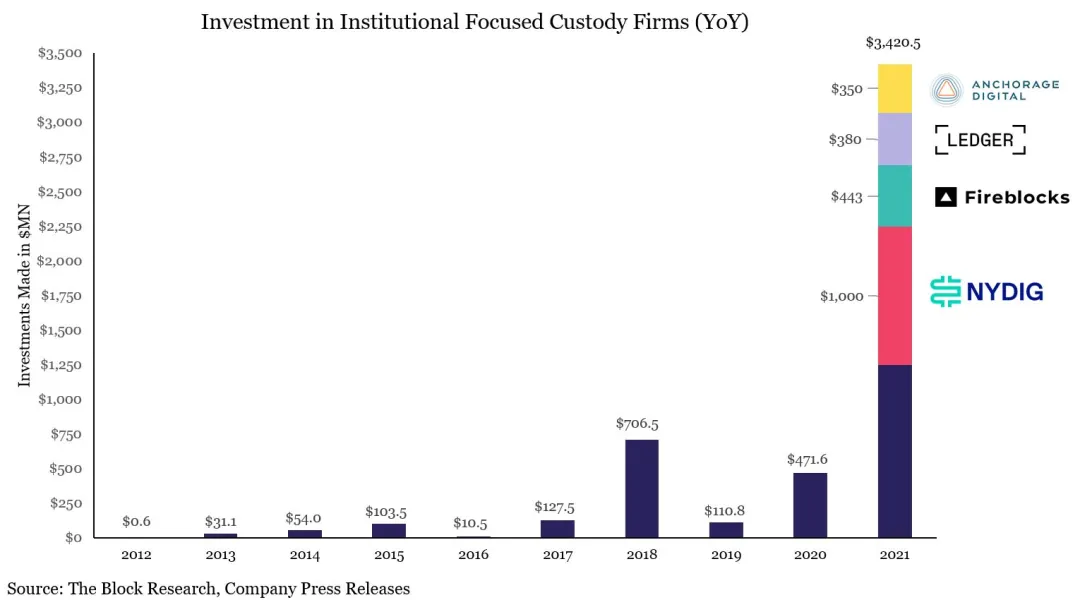

Compared to the sheer scale of capital pouring into the dollar, Treasuries, and U.S. equities, crypto is still just catching what it can in a small bucket. Only a big, secure “bathtub” will allow true, seamless liquidity flows.

Veteran players are diverging, and Anchorage Digital and Galaxy Digital now stand out as the industry’s two flagship examples.

- • Treasury management (DATCO): Galaxy

- • Stablecoins: Anchorage

- • Emerging ETF staking: Anchorage Digital & Galaxy Digital

Apart from BTC and spot ETF businesses, both companies target the same thing—taking more market share from Coinbase. This is a logical starting point.

The spot ETF market now features two main trends: generalization (altcoins and meme coins, after six months of Coinbase derivatives trading, may become eligible for conversion into ETFs); and the rise of staking ETFs, which allow issuers to offer physical redemptions and tap into on-chain staking revenue.

Anchorage Digital, for example, is the exclusive custodian and staking partner for the REX-Osprey Solana Staking ETF—fitting both these trends. If the bull market continues, ETF custody will be a key growth engine for these firms.

On the traditional ETF front, Anchorage has won mandates from 21Shares and BlackRock—and is even custodian for Trump Media’s Bitcoin treasury. Anchorage’s reach now extends all the way to Mar-a-Lago.

Anchorage: Licensed Banking for Stablecoins and the Pursuit of the Crypto Fort Knox

In 2019, Anchorage began exploring partnerships with Visa, becoming Visa’s USDC settlement bank in 2021.

In 2021, Anchorage launched its crypto custody business at a $3 billion valuation, received a crypto bank charter from the OCC, and began providing digital asset custody for the U.S. Marshals Service (USMS).

In 2022, following the crypto crash, Anchorage was first choice for Aptos custody, with co-founder Diogo Mónica also an Aptos investor.

In Q1 2023, platform assets grew 80%, though 75 employees (20%) were laid off and the company called for stablecoin regulation.

In 2024, co-founder Diogo Mónica stepped away from daily operations, with Nathan McCauley assuming full responsibility.

By 2025, Anchorage Digital will manage Trump Media’s Bitcoin treasury and has acquired USDM issuer Mountain Protocol.

Here’s a formal introduction: Anchorage Digital was founded in 2017 by Nathan McCauley and Diogo Mónica, initially as a small trust in South Dakota. But in 2021, a twist of fate made Anchorage Digital the only recipient, so far, of an OCC-issued crypto bank charter in the U.S.

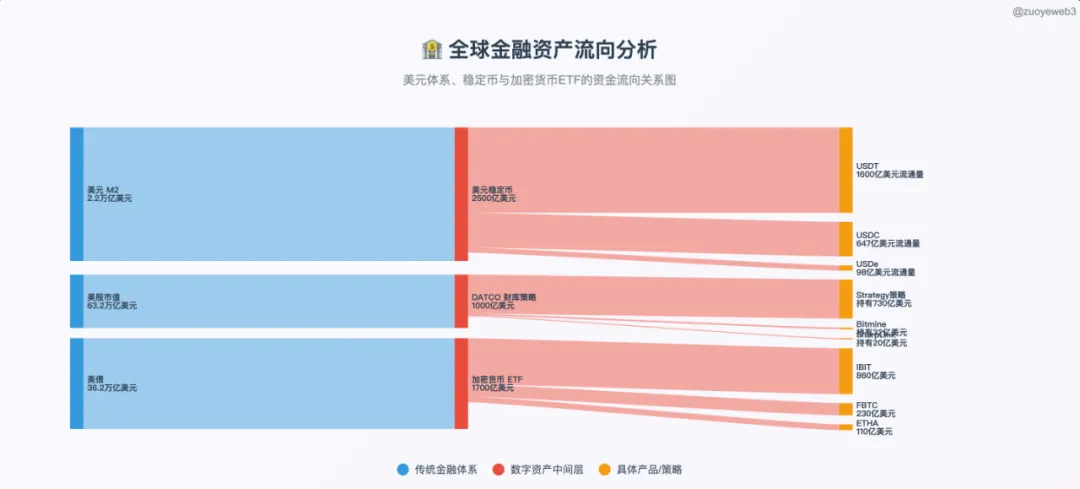

In Silicon Valley, Wall Street, or D.C., exclusive financial services are, at their core, all about relationships.

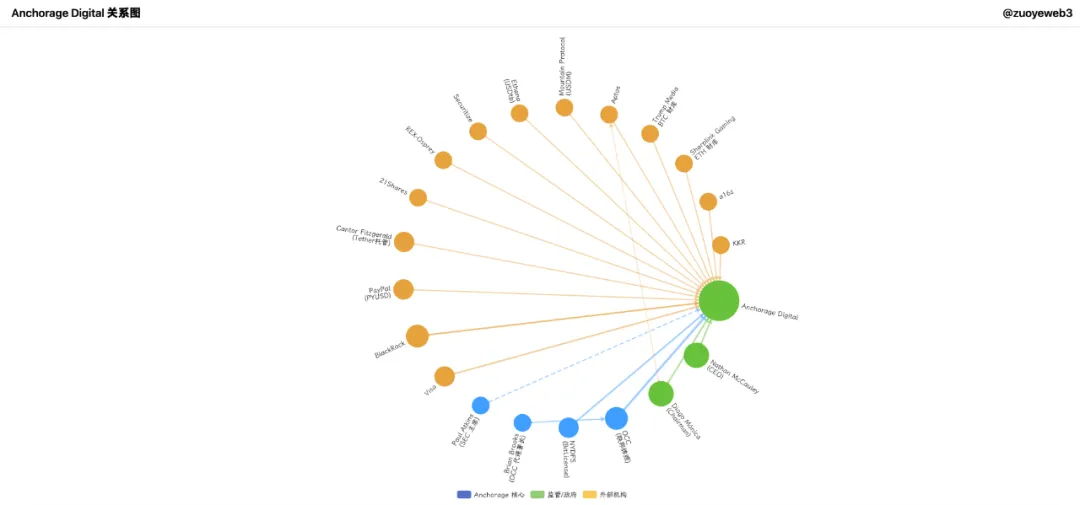

Image Description: Anchorage Digital’s Relationship Map

Image Source: @zuoyeweb3

Anchorage Digital built a full-service institutional platform—trading, derivatives, clearing, staking, custody—making it a one-stop crypto solution for institutions. Beyond traditional custody, Anchorage is betting the company’s future on stablecoins, its key difference from Galaxy.

This marks the beginning of their first-mover advantage, where timing proved critical.

In 2021, Democrat Joe Biden, a noted crypto skeptic, became president. SBF donated millions to support Biden in hopes of a “crypto spring.” Meanwhile, former Coinbase CLO Brian Brooks became Acting Comptroller of the OCC.

Brooks promoted a crypto-friendly stance, opened banking services to the sector, launched the “REACh” roundtable, and encouraged banks to treat crypto firms fairly.

Anchorage seized the opportunity, transforming from a local trust to Anchorage Digital Bank—a true national bank.

On January 13, 2021, Anchorage Digital Bank was qualified to accept USD deposits and custody crypto assets.

The next day, January 14, Brooks resigned. By a fluke of timing, Anchorage Digital became the sole licensed crypto bank in the United States.

Today, virtually every page of Anchorage Digital’s site touts the value of its charter—it enabled $430 million in Series C and D funding, keeping the company afloat for the 2025 stablecoin surge.

Anchorage boasts an impressive cap table: both crypto VCs like a16z and Wall Street giants like KKR and BlackRock have invested.

For context, Bitpay and Paxos also applied for a charter, but weren’t so lucky. Recently, Paxos was hit by a $26.5 million New York DFS fine for BUSD non-compliance.

In addition to its federal OCC crypto bank charter, Anchorage also holds a New York State BitLicense—second only to BNY in regulatory status.

After Brooks’s departure, Anchorage and the OCC had their disagreements, but Anchorage kept its charter—holding a unique license provides a lasting advantage.

Thanks to this regulatory status, Anchorage can custody everything from stablecoin reserves and crypto to NFTs. But the 2022 crypto crash disrupted the firm, with leadership clashes following soon after.

Ultimately, Diogo Mónica joined Hanu Ventures as a partner, remains Anchorage Digital’s executive chairman, leads hiring and strategy, and Nathan McCauley handles core operations—focusing on capturing BlackRock’s stablecoin business.

Anchorage is now custodian for 21Shares’ BTC and ETH spot ETFs and exclusive custodian and staking partner for the REX-Osprey Solana Staking ETF.

But beyond ETFs, Anchorage Digital has made major headway—especially in stablecoins: collaborating with Visa on stablecoin payments and onboarding “compliant” stablecoins like PayPal’s PYUSD for institutional investors.

Remarkably, Tether’s custodian and investor Cantor Fitzgerald has also teamed up with Anchorage to handle Bitcoin custody for Cantor Fitzgerald’s business.

That makes Anchorage the custodian to Tether’s custodian.

Despite its regulatory edge, Anchorage’s business was relatively quiet before 2025. Even with a $3 billion valuation and $50 billion in assets under management (AUM), it struggled to challenge Coinbase in the ETF space. Stablecoins are Anchorage Digital’s real battleground.

With its federal “crypto bank” charter, Anchorage Digital (through Anchorage Digital Bank NA) can accept both USD and stablecoin deposits, and provide custody services.

- • Off-chain: Anchorage is partnering with Ethena to scale up USDtb issuance and comply with Genius Act stablecoin requirements.

- • On-chain: Anchorage is part of the USDG stablecoin alliance with Paxos and Kraken, operating the Global Dollar Network on-chain.

In treasury strategy, Anchorage is not idle: former BlackRock exec Joseph Chalom joined ETH treasury firm Sharplink Gaming as co-CEO and drove the BlackRock–Anchorage ETF custody partnership.

BlackRock’s BUIDL fund is closely linked to Chalom, and Anchorage serves as custodian. The structure:

$BUIDL = BlackRock issuance = Securitize (tokenization tech) + Anchorage Digital (custody) + BNY (cash management)

There’s more: SEC Chair Paul Atkins owns at least $250,000 of Anchorage Digital shares and is also a Securitize stakeholder; Securitize is Ethena’s joint partner for Converage.

With Galaxy listed publicly, speculation about an Anchorage Digital IPO is growing as the stablecoin business expands—perhaps this will be the year of the first crypto bank IPO.

Galaxy Digital: Sitting Atop the Crypto Treasury Throne

Galaxy Digital stands out even more than Anchorage. It was Goldman Sachs’s OTC crypto trading partner in 2022, a major Bitcoin whale exit hub, and is involved in BTC mining, VC investment, and AI compute. Founder Mike Novogratz’s connections are unmatched in the industry.

On July 25, Galaxy helped an early miner sell about 80,000 BTC ($9 billion). Although the sales were staggered, the news pushed Bitcoin down nearly 4% to below $115,000.

Given the sums involved, Galaxy has faced accusations of market manipulation, but as an institution, Galaxy’s incentives are for low volatility and scale—institutions want stability, not chaos.

However, Galaxy’s real advantage is its timing: founder Mike Novogratz—trained in traditional finance, not tech—has always approached crypto pragmatically, focusing on profitability.

Now, as retail exits and institutions enter, Galaxy’s next steps—especially the broadening of crypto treasury strategies—demand attention.

Recall that ETH treasury company Sharplink, recently led by a BlackRock executive?

In June 2025, Sharplink made multiple large ETH buys via Galaxy OTC, totaling at least $800 million. Galaxy is also a Sharplink investor—internal capital cycling within related entities.

Beyond BTC and ETFs, Galaxy has contributed to Ethena’s Stablecoinx treasury effort and built the $450 million Mill City Ventures III, Ltd. $SUI treasury.

Galaxy is also expanding into new OTC products, such as OTC support for LST LsETH (Liquid Collective issuance). For the SOL version (lsSOL), institutional investors are supported by Anchorage Digital.

It’s a tight circle at the top of crypto finance.

Notably, both Anchorage Digital and Galaxy Digital are now involved in GDN, proving that collaboration, not cutthroat competition, is the new norm among major custodians.

While Anchorage is betting its future on stablecoins (thanks to its banking charter), Galaxy focuses on treasury management, with additional non-BTC and non-ETH treasury products forthcoming.

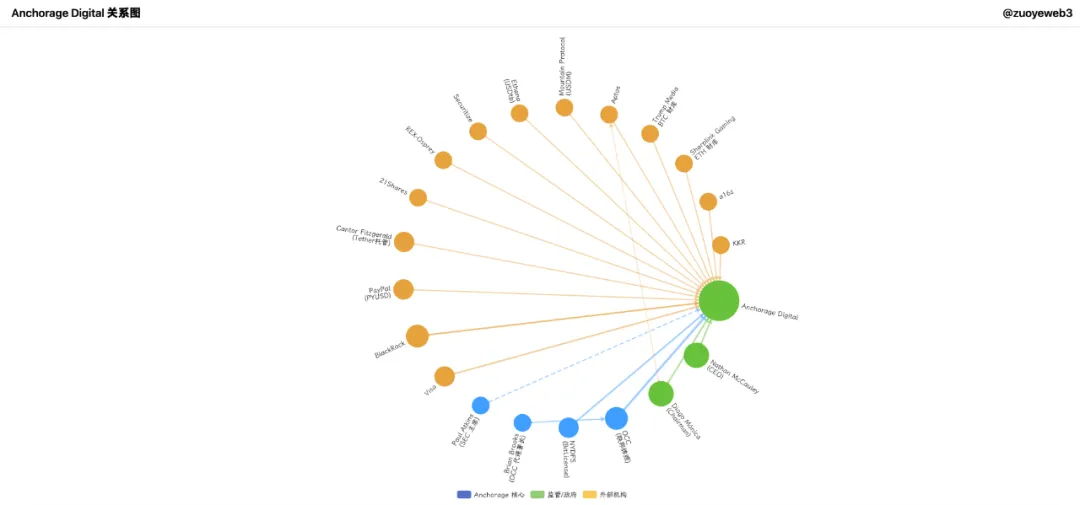

With substantial capital depth, Galaxy holds $1.8 billion in BTC, recently increased its XRP holdings by $34.4 million, and in a twist, Ripple just announced a $200 million acquisition of stablecoin firm Rail (backed by Galaxy).

Internal capital cycling within related entities.

Galaxy’s filings hint at new treasury and market-making targets: $HYPE, $SOL, and $XRP. After Ripple ended its SEC litigation and soared 10% the same day, Galaxy pulled ahead of retail once more.

Image Description: Galaxy Digital Portfolio

Image Source: @zuoyeweb3

Data Source: @SECGov

Galaxy has completely exited its UNI and TIA positions. The previous leading assets have been replaced: USDG, HYPE, and XRP are the new stars—OTC desks always spot the trends first.

Historically, OTC desks could only passively fill whale orders, with little sway over secondary markets—unlike exchange-based market makers. However, with on-chain treasury strategies, crypto, equities, and bonds will become interconnected; who will control token pricing remains uncertain.

Conclusion

Custodians are the new crossroads of capital in crypto. Off-chain assets demand secure on-chain entry; on-chain assets require compliant off-ramps. Treasury strategies will let custodians actively shape token prices. Crypto liquidity now defines the power structure, while the era of centralized exchanges and market makers is coming to an end.

BNY Mellon holds over $52 trillion in assets under custody. The entire crypto market cap is less than $4 trillion, and stablecoins + crypto ETFs + treasury firms total just $520 billion—crypto custodians’ influence will take time to mature.

Ultimately, capital will follow profit opportunities.

Disclaimer:

- This article is reprinted from [Zuoye WaiBoShu]. Copyright remains with the original author [Zuoye WaiBoShu]. If there are any objections to this reprint, please contact the Gate Learn team, and we will address it according to our procedures.

- Disclaimer: The views and opinions expressed in this article belong solely to the author and do not constitute investment advice.

- Other language versions of this article were translated by Gate Learn. Unless Gate is specifically referenced, translated content may not be copied, distributed, or plagiarized.

Image Description: Custodian Funding Boom

Image Source: @zuoyeweb3

Image Description: TradFi & DeFi Merge

Image Source: @zuoyeeb3

Image Description: Anchorage Digital’s Relationship Map

Image Source: @zuoyeweb3

Image Description: Galaxy Digital Portfolio

Image Source: @zuoyeweb3

Data Source: @SECGov

Your Gateway to Crypto World, Subscribe to Gate for A New Perspective